Information you need to live a happy, worry-free retirement!

Originally published December 30, 2015, last updated December 30, 2015

The Dangers of Delaying Your Initial Medicare Enrollment

Procrastinators, beware. In some cases, if you put off your initial enrollment in Medicare, you could end up uninsured for several months. Careful coordination of your existing health care coverage as you transition to your new Medicare coverage is crucial, in order to avoid incurring medical costs that could be devastating during a lapse in coverage.

For example, let’s say a woman named Marge turned 65 in September. That means her Initial Enrollment Period is August through February. She’s been covered under her husband’s employer-provided insurance, but it ended on Nov. 15. Often, employers or their group health plans determine the date that group coverage ends for an employee turning 65 and enrolling in Medicare. So she waited until November to apply for Medicare. But because of Medicare rules, her Medicare Part B coverage won’t actually start until February, meaning she will only have part A for three months.

So how is it possible that your Medicare coverage could be delayed if you still enroll within your allotted Initial Enrollment Period?

There are a couple ways you enroll in Medicare. If you are already receiving Social Security benefits when you become eligible for Medicare and have enough work quarters to qualify, you will be automatically enrolled in Medicare Part A (hospital insurance) and Part B (medical insurance) when you turn 65 or on your 25th month of disability.

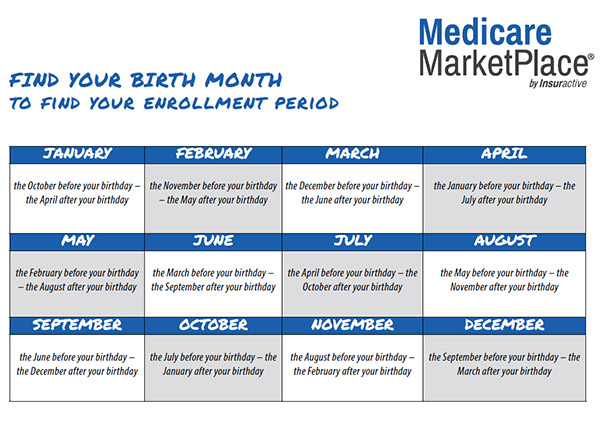

But you will need to apply for Medicare if you are not yet collecting Social Security benefits when you turn 65 or decide to delay taking your benefits past your retirement age. For those not automatically enrolled, you can enroll during Medicare’s Initial Enrollment Period, a seven-month window that starts three months before the month you turn 65, includes your birth month and concludes three months after the month you turn 65. To find your Initial Enrollment Period, find your birth month in the chart below.

If you do not enroll during your Initial Enrollment Period or do not provide proof of insurance under another eligible plan, you will pay a substantial penalty each month.

The Centers for Medicare and Medicaid Services (CMS) advises that you sign up early to avoid a delay in coverage. To get Part A and/or Part B the month you turn 65, you must sign up during the first three months before the month you turn 65.

If you wait until the last four months of your Initial Enrollment Period to sign up for Part A and/or Part B, your coverage will be delayed. Refer to the CMS chart below to see how long that coverage would be delayed.

Lapses in coverage often occur when people mistakenly set a date to terminate their existing coverage, such as their employer-provided health plan, based off of when they think their Medicare coverage starts, not when it actually does.

Check with your benefits coordinator at work or your existing insurance plan coordinator to see how your private plan fits with Medicare. And if you’re going to terminate that private coverage, terminate it after your Initial Enrollment Period.

If you sign up for Part A and/or part B during the first three months of your Initial Enrollment Period, your coverage start date will depend on your birthday:

- If your birthday isn’t on the first day of the month, your Part B coverage starts the first day of your birthday month. For example, Tom’s 65th birthday is July 20. If he enrolls in April, May or June, his coverage will start on July 1.

- If your birthday is on the first day of the month, your coverage will start the first day of the prior month. For example, Ida’s 65th birthday is July 1. If she enrolls in March, April or May, her coverage will start on June 1.

In addition to your Initial Enrollment Period, you can sign up for Medicare two other times:

- General Enrollment Period — If you didn’t sign up for Part A and/or Part B when you were first eligible, you can sign up between January 1 and March 31 each year. Your coverage will begin July 1. However, you may have to pay a higher premium for late enrollment.

- Special Enrollment Period — You can sign up using a Special Enrollment Period only if you meet certain requirements. If you enroll using a Special Enrollment Period, your Medicare coverage will begin the month after Social Security gets your completed request. Usually you don’t pay a Part B late enrollment penalty if you sign up during a Special Enrollment Period. But, you cannot enroll using a Special Enrollment Period if your employment or the employer-provided group health plan coverage ends during your Initial Enrollment Period, according to the Social Security Administration’s “Medicare” booklet.

So again — don’t procrastinate. Sign up early, during the first three months before the month you turn 65, to avoid a delay in coverage. And talk to your employer or existing health care insurance provider to understand when your existing plan ends, so there are no lapses in coverage.