Information you need to live a happy, worry-free retirement!

Originally published February 22, 2019, last updated February 26, 2019

The High Cost of Specialty Tier Drugs in 2019 for Medicare Part D Enrollees

Many Medicare Part D beneficiaries continue to face high out-of-pocket costs for their medications in 2019, a new analysis shows.

While Medicare Part D Prescription Drug coverage has helped make drugs more affordable to older Americans, the analysis of 2019 Medicare Plan Finder data by the Kaiser Family Foundation shows that Part D enrollees who do not receive low-income subsidies can still expect to pay thousands of dollars in out-of-pocket costs for a single specialty tier drug in 2019.

Medicare defines specialty tier drugs as those that cost more than $670 per month in 2019. Even though a small share of Medicare Part D enrollees take specialty tier drugs, spending has increased significantly over time, meaning those taking these drugs face burdensome expenses. Spending on specialty drugs now accounts for more than 20% of total Part D spending, up from about 6 to 7% before 2010.

Here are some of the Kaiser Family Foundation analysis’ key findings.

Average Out-of-Pocket Cost: $8,109

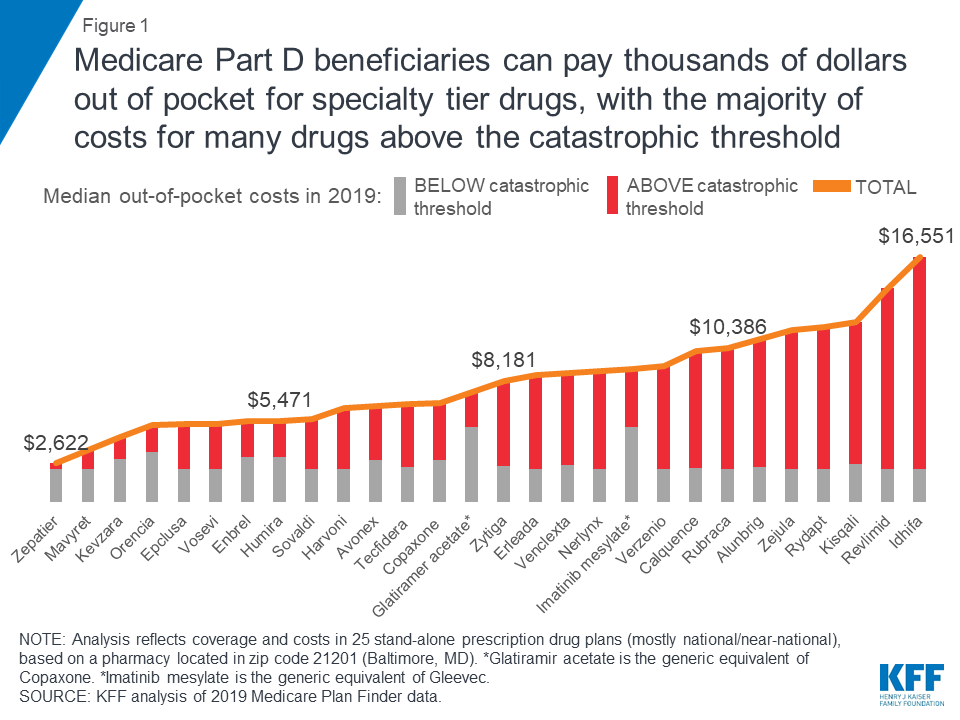

According to the analysis of 2019 Medicare Plan Finder data by the Kaiser Family Foundation, expected annual out-of-pocket costs in 2019 average $8,109 across the 28 specialty tier drugs covered by some or all plans in this analysis. The median annual out-of-pocket costs range from $2,622 for Zepatier (for hepatitis C) to $16,551 for Idhifa (for leukemia) based on a full year of use. And two of the 30 drugs in the analysis are not covered by any plan in 2019.

Annual Out-of-Pocket Costs Rise 12%

In 2019, expected annual out-of-pocket costs for eight of the 10 specialty tier drugs are 12% higher than in 2016, on average (an increase of $873). For these specialty tier drugs, median annual out-of-pocket cost increases range from $224 for Copaxone, a multiple sclerosis drug, to $2,923 for Revlimid, a cancer drug. However, for two of the 10 drugs — Harvoni and Sovaldi, both used to treat hepatitis C — annual out-of-pocket costs are somewhat lower in 2019 than in 2016, possibly due to the entrance of competitor products since the end of 2015 and other factors related to changes in the benefit design and the limited duration of treatment that translate to a reduction in out-of-pocket costs for these drugs.

Significant Costs Occur in Catastrophic Phase

Part D coverage has four phases — the deductible phase (in which you pay the full drug cost until you hit your deductible), the initial coverage phase (in which cost-sharing begins), the coverage gap or “donut hole” (in which you pay more than the insurance plan pays until you hit a certain amount), and the catastrophic phase (in which your costs drop dramatically after you’ve paid a certain amount). Despite that drop, there is no hard cap on spending in the Part D benefit.

The Kaiser Family Foundation analysis showed that although Part D offers catastrophic coverage for high drug costs, Part D enrollees taking high-cost specialty tier drugs can incur significant costs in the catastrophic phase. For the 28 specialty tier drugs covered by some or all plans in the analysis, the share of out-of-pocket costs that an enrollee would incur in the catastrophic phase in 2019 ranges from 13% for Zepatier to 86% for Idhifa, based on a full year of utilization. More than half (61%) of expected annual out-of-pocket costs for these 28 drugs in 2019 would occur in the catastrophic phase, on average, which translates to $5,444 in out-of-pocket costs in the catastrophic phase alone.

Not All Specialty Drugs Are Covered

Not all specialty tier drugs are covered by all Medicare Part D plans, unless they’re in one of the six protected classes (such as cancer drugs). For the 14 specialty drugs analyzed that are not covered by some or all plans in 2019, the median total annual cost when not covered ranges from $26,209 for Zepatier to $145,769 for Gleevec — amounts that far exceed the limits of affordability for the vast majority of Medicare beneficiaries. For the 12 specialty tier drugs in the analysis covered by some but not all plans, the median annual cost among plans that do not cover the drug is at least 10 times higher than the median out-of-pocket cost when it is covered.

Help to Manage Your Part D Costs

While you cannot control the cost of prescription drugs and how Medicare covers them, there are steps you can take to manage your costs. One of the most important steps is to review your Part D coverage annually during Open Enrollment Period, which is Oct. 15 through Dec. 7, and shop for plans. The Licensed Insurance Agents at Medicare MarketPlace®, a Mature Health Center® partner, can compare plans so you don’t have to, and they can help decipher plan differences. It’s important to review your plan annually, because plans, premiums and drug formularies can change each year. As the Kaiser Family Foundation analysis shows, if a drug is not in your formulary or not covered, your out-of-pocket costs can be beyond what you can afford.

For more on how to manage your prescription drug costs, check out these Mature Health Center articles:

- Understand how to read your Medicare Part D drug formulary.

- Compare Medicare prescription drug plans to control costs.

- If you use insulin, understand how insulin can often spike your share of costs.

- 3 things you can do to cut your prescription drug costs.

If you’re not already subscribed to the monthly Mature Health Center eNewsletter, subscribe now to get more useful information on controlling health care costs.