Information you need to live a happy, worry-free retirement!

Originally published March 6, 2017, last updated March 10, 2017

Insulin and the Donut Hole: Lifesaving Drug Often Spikes Medicare Patients' Share of Costs

Many diabetes patients requiring insulin will end up in the Medicare coverage gap known as the “donut hole,” where they’re responsible for a greater share of the drugs’ costs.

When this happens, a patient’s out-of-pocket costs at the pharmacy spike dramatically — for example, from a $40-per-month co-pay to $350 a month. Even worse, some patients struggling with the expenses will drop or stop dosages or switch brands — decisions that can be dangerous to their health if not overseen by their doctor and can actually keep them in the donut hole, costing even more. These erratic costs can be a financial and emotional rollercoaster.

Managing these costs is especially challenging amid the current firestorm of skyrocketing pharmaceutical prices. A version of insulin with a list price of $17 a vial in 1997 is priced at $138 today, and another that launched 20 years ago with a sticker price of $21 a vial has soared to $255, according to The Washington Post. PBS Newshour reports that the annual cost of insulin reached $736 per patient in 2013, up threefold since 2002.

Understanding how Medicare Part D Prescription Drug coverage works in regard to insulin can help you plan for price increases and the likelihood that you’ll enter the donut hole coverage gap. To help you, we’ll take you — chronologically — through a calendar year of expenses that a typical patient with diabetes on two forms of insulin may pay, so you can see real-world examples of how the four coverage phases can impact finances. But keep in mind that everyone’s situation can vary greatly, depending on their individual drug plans, other prescriptions and multiple other factors.

The four Part D coverage phases

First, it’s important to understand how your coverage works. Medicare Part B (medical insurance) does not cover insulin — unless use of an insulin pump is medically necessary. (If you use an external insulin pump, Part B may cover the insulin and the pump.) So having Part D — supplemental prescription drug coverage — is critical for many people to afford injectable insulin.

Medicare Part D Prescription Drug coverage has four phases:

- The deductible phase — you pay the full drug cost until you hit your deductible

- Deductibles vary, but none can be higher than $400 in 2017

- The initial coverage phase — cost-sharing begins; you pay co-payment or co-insurance until you hit your plan’s initial coverage limit

- The initial coverage limit varies by plan but is $3,700 in most plans in 2017

- The coverage gap or “donut hole” — your plan does not pay

- In 2017, you pay 40% of your plan’s price for covered brands, 51% of your plan’s price for covered generic drugs, until your out-of-pocket expenses hit $4,950

- The catastrophic phase — your costs drop dramatically after you’ve paid a certain amount

- You pay either 5% of total drug costs or $3.30 for generics and $8.25 for brand name prescriptions

How the donut hole works

When the medication costs shared by you and your plan have reached an amount set by the government, you enter the donut hole. This government-determined amount changes every year, but for 2017, it is $3,700. Once you hit that amount, you move from cost-sharing to paying for your prescriptions on your own again. You pay a discounted price for brand-name and generic drugs until your out-of-pocket spending hits a catastrophic amount. The catastrophic amount in 2017 is $4,950.

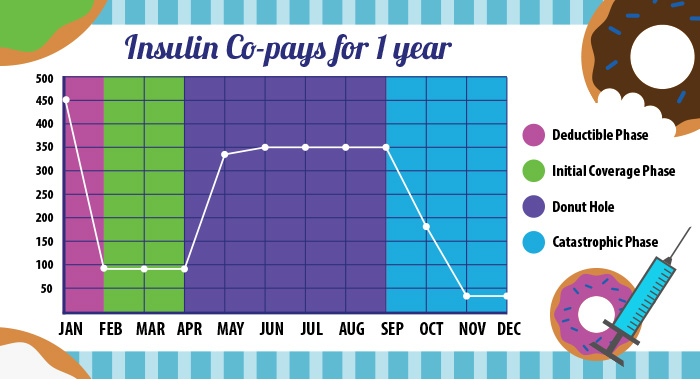

The high cost of insulin makes it common for insulin-reliant Medicare patients to hit the donut hole, sometimes early in a calendar year. For the sake of simplicity, we will look at someone who only is on insulin and no other prescriptions. In our example, we’ll call this person George and say he is on two insulin drugs, Lantus and Novolog. The bar graph shows the amounts that George would pay in out-of-pocket costs for the same amount of insulin at the pharmacy during the four coverage phases:

Because George’s Medicare Part D Prescription Drug plan has a $400 deductible, he must pay the full cost of drugs starting in January until he hits that deductible. He easily hits his deductible in January right off the bat because of the full cost of his drugs: $380 for Lantus and $503 for Novolog.

After he met his deductible, he moves out of the deductible phase and into the initial coverage phase, in which he pays a co-pay of $47 for Lantus and $47 for Novolog — for a total of $94 a month — from February through April.

In May, George’s drug costs hit his plan’s initial coverage limit of $3,700, triggering the next phase, which is the donut hole. In this phase, the amount that George must pay now jumps to 40% of the total cost of the medication — that makes his payments $150 for Lantus and $200 for Novolog. (So instead of the $94 a month he paid in the previous three months, he now will pay $350 a month.)

By the end of October, George’s “true out-of-pocket costs” as defined by the government hit $4,950 transitioning him out of the coverage gap and into the catastrophic coverage phase. During November and December, he will only pay 5% of the total cost. That’s $19.01 a month for Lantus and $25.15 for Novolog.

Trying to figure out when you will hit the donut hole and when you get out can be confusing, because many factors contribute to the calculation. For example, you fall into the donut hole coverage gap once you and your plan have spent $3,700. So, even though George hit the $3,700 threshold that got him into the donut hole and the $4,950 threshold that got him out of the donut hole, the amount he ultimately paid for insulin was more than $2,700. And that total does not include the cost of medical supplies used to inject insulin, such as syringes, gauze, and alcohol swabs. Nor does it include the cost of other medications, which can dramatically skew out-of-pocket costs.

It’s common for patients with diabetes to require more than one vial of insulin per month and often more than one brand of insulin to control their blood sugar level. To further add to the financial burden, patients often require higher and higher doses of insulin over time as the insulin receptors in the body become less sensitive and less responsive to the current insulin dose. And they often suffer other complications, such as kidney disease, skin and eye conditions, and neuropathy, adding to the overall costs they pay. Medical costs for people with diabetes are twice as high as for those without it, according to the American Diabetes Association.

How to manage insulin costs

It’s imperative for patients on insulin with Part B to budget for the high and increasing costs of insulin.

Every year, Medicare patients on insulin should review their coverage and compare their coverage options during Medicare’s Open Enrollment Period, Oct. 15 through Dec. 7. This is when all people with Medicare can change their Medicare health plans and Part D Prescription Drug coverage for the following year. Many people conduct their annual reviews with their local senior centers or pharmacists, but Medicare insurance specialists, like the Licensed Insurance Agents at Medicare MarketPlace®, can compare plan prices from multiple carriers to find you the best benefits and best price. Before you call, have a list of your current insulin prescriptions and other prescriptions ready. The agents can walk you through a calendar year, as in this article, so you can see when your insulin costs — and other prescriptions — may push you into the donut hole.

Most importantly, they can help you see that plans with the lowest monthly premiums are not always the better financial choice, especially because the high cost of insulin and other drugs can push you into the coverage gap, often much sooner than you would expect. Because the donut hole is confusing and many people don’t understand it, it’s easy for them to recommend or to default to the plan with the lowest monthly premium. But this can cost you more in the long run. Make sure you’re evaluating all of your options and asking about the donut hole.

Once you decide on the best plan for your budget, then you can take note of the monthly cost projections that your Licensed Insurance Agent provides, so that you won’t be surprised when you go to pay at the pharmacy. While you may not be able to eliminate falling into the donut hole or the erratic price jumps of the different Part D coverage phases, you can take note of your deductible and co-pays each month so you can set that money aside.

Patients who find themselves without the money needed to get their insulin can speak with their doctor about possibly transitioning to Relion insulin, available at Walmart pharmacies for $25 to $50 a vial. Some patients do this when they find themselves in the costly coverage gap when they know they won’t spend enough to reach the catastrophic phase, but it requires their doctor to help them adjust the dose and prevent complications. Be careful that this will not keep you in the high-cost donut hole, however. Staying on a higher-cost brand-name drug may be more cost-effective overall because it may get you out of the donut hole faster.

Savvy patients have learned to stock up on expensive medications when they are in the catastrophic phase of coverage. In our example, George would be best served by getting a three-month supply in December when he’s only paying 5% of the total drugs’ cost.

According to Express Scripts, a pharmacy benefits manager, diabetes medicines, including insulin, are the second most expensive category of prescription drugs. Managing this financial challenge can seem daunting, especially with the cost of insulin rising. Discuss your options with your doctor or pharmacist and remember to review your plan annually. Medicare MarketPlace also has an on-staff pharmacist to answer the more complicated questions about your insulin.

If you have any questions about your Part D Prescription Drug coverage, call Medicare MarketPlace at 1-800-639-0781 to speak to a Licensed Insurance Agent or the pharmacist.